Assisted Onboarding

Help your customer with Onboarding

SUMMARY

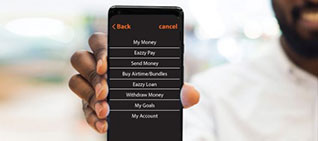

Assisted Onboarding from Modefin will simplifies and fasten the processes through advanced tools, automated verifications, and effective data captures. It empowers banks and financial institutions to effortlessly assist customers using AI-driven services like image extraction, photo validation with match scores. Seamless integration with national ID databases streamlines the KYC documentation process while adhering to regulatory standards. The omnichannel data capture system facilitates rapid and accurate collection of customer information from various sources.

value proposition Why Assisted Onboarding from Modefin

Automated extraction of customer information from documents and images using AI algorithms and OCR extractions, reducing manual data entry in the onboarding processes.

Incorporates maker and checker roles framework to view and edit customer applications for account opening and other services

Capability to collect customer information from various sources, databases, channels and capture systems ensuring a seamless approach to data collection.

Inclusion of biometric authentication methods, such as fingerprints, facial recognition and live capture of customer signature for real time identity verification.

Adherence to regulatory standards and guidelines, ensuring that the onboarding processes meet legal requirements for a secure and encrypted customer interaction framework.

Insights

Success Stories

Universal Merchant Bank Ghana

Universal Merchant Bank (UMB) is a leading indigenous bank in Ghana which offers a diverse range of financial services to meet the banking needs of its customers.

Equity Bank Kenya

Equity Bank Fuels massive Transformation; migrates 3.5 mn SIM application Tool kit users and brings flexibility, stability and cost savings.

Featured Blog Posts

AI in Banking: Use cases of Artificial Intelligence and Machine Learning in Banking

Artificial intelligence (AI) and machine learning (ML) have driven the inception and

Benefits of Upgradation from Monolithic to Microservices platform in Banking

Microservices architecture has grown in popularity in recent years, notably in industries

Micro Lending – The Future of Borrowing

Welcome to the future of lending! The financial landscape is undergoing a