IBSI GFIA 2023

Digital Banking Product Suite Award

PHILOSOPHY Making sure our customers win the race with our suite of award-winning solutions

Customers Served

Agents

Merchants

Integrations

WHAT WE OFFER? Robust Products for Banks of the Future

Omnichannel Banking

An integrated Omnichannel Banking designed to help banks deliver modern customer experiences.

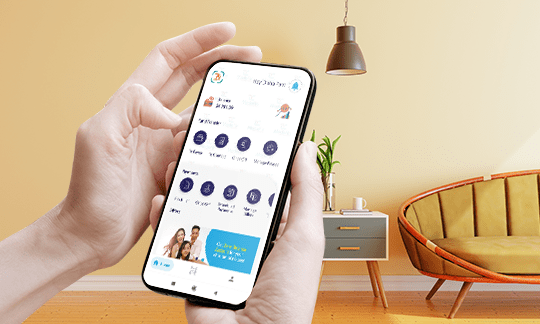

Mobile Banking

Modefin offers an intuitive, highly secure and reliable mobile banking solution tailored to meet the business needs of banks.

Internet Banking

Offer seamless and personalized experiences to your customers by leveraging advanced internet banking modules from Modefin.

Agent Banking

Reach out to millions of new customers with our low cost, secure and scalable Agent Banking Solution.

Mobile Wallet

Meet the needs and demands of modern-day customers with a flexible and scalable mobile wallet solution.

Digital Lending

A scalable & flexible solution to automate bank/mobile wallet operations encompassing savings & small-value lending services.

Experience Speaks