Internet Banking Solution from Modefin

Connect to the net. Bank anywhere, anytime!

SUMMARY

value proposition Why Bank on Internet Banking from Modefin

Exclusive modules to serve the needs of diverse categories of customers

Empowers Retail Banking customers to make transfers and 3rd party payments

Corporate customers can initiate requests for demand draft, checkbook, account statement, Letter of Credit and issue of LC/LG

Facility for Bulk Payments such as salary payouts, dividends or refunds.

Supports multiple agent relationships, multiple locations and multiple correspondent banks within a country.

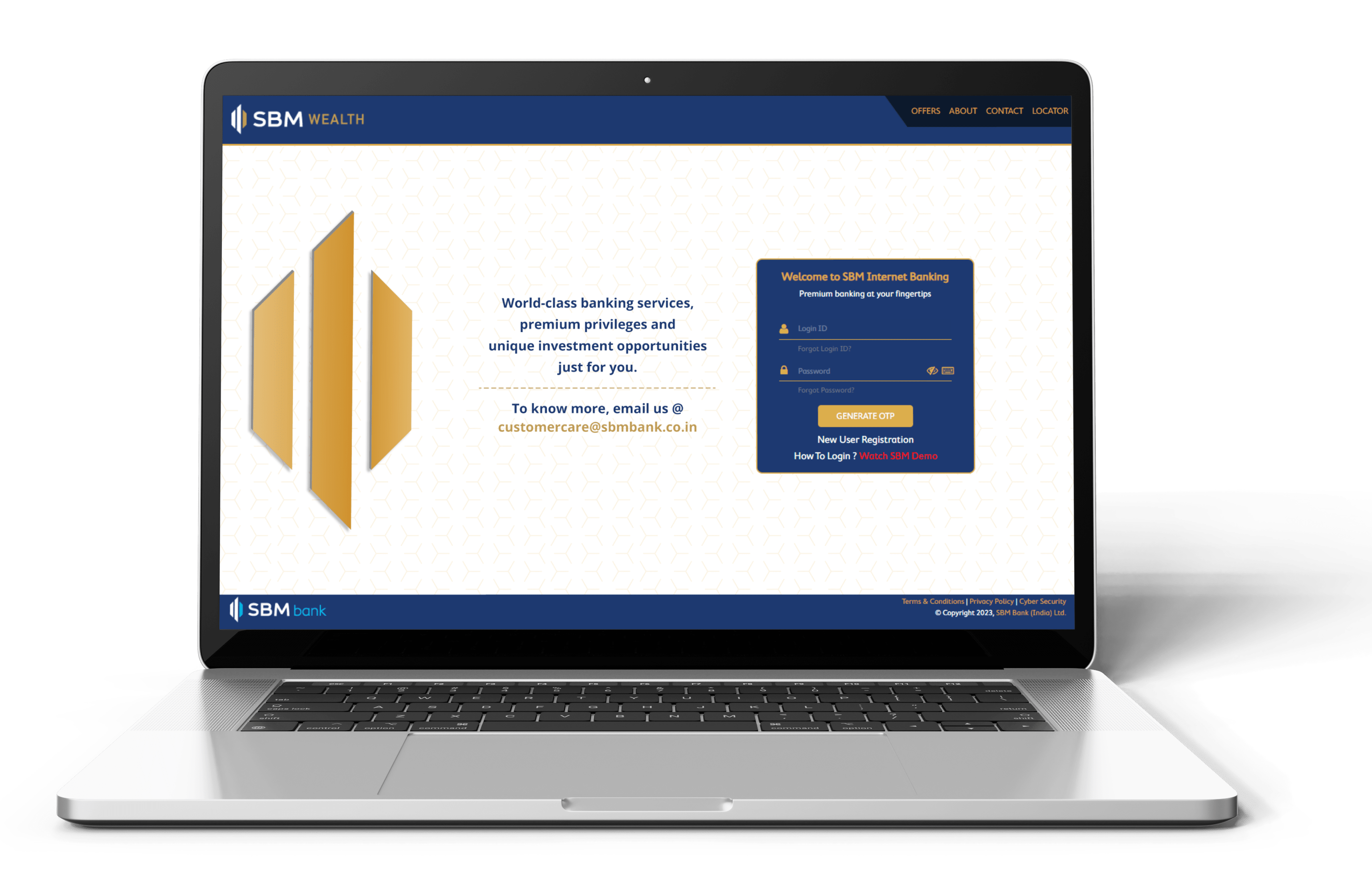

USER CASE STUDY SBM Internet Banking

After a rigorous selection procedure comprising leading solution providers, the SBM bank chose Modefin to create a differentiated proposition in the Indian Banking sector. The Bank invested in scalable technology and customizable multiple-channel delivery platforms designed by Modefin.

The OEBP solution from Modefin integrates seamlessly with Aadhar, the Core Banking System, and all other 3rd party systems. The implementation provided a Digital Platform integrated with the UPI payment system and Bharat Bill Pay System (BBPS). The integration of a Card Control API module enabled cardholders to track how, when, and where their cards are used.

To learn more about Internet Banking download our brochure

Insights

Success Stories

Universal Merchant Bank Ghana

Universal Merchant Bank (UMB) is a leading indigenous bank in Ghana which offers a diverse range of financial services to meet the banking needs of its customers.

Equity Bank Kenya

Equity Bank Fuels massive Transformation; migrates 3.5 mn SIM application Tool kit users and brings flexibility, stability and cost savings.

Featured Blog Posts

Beyond the Browser: Reimagining Net Banking for the Connected Consumer.

The modern consumer lives in an interconnected world, where every interaction, from

Digital Onboarding & User Experience: The Gateway to the Modern Financial Customer

In an age defined by instant gratification, the customer journey begins long

How Chama Management Systems Fosters Financial Inclusion?

Savings and lending groups, also known as Chamas, have long been a