Micro Savings and Lending Solution from Modefin

SUMMARY

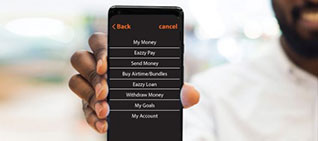

A digital solution designed for account holders with a lower float, lesser income and greater propensity to save or borrow smaller amounts. At the click of an icon, the customer is taken into a virtual zone that addresses every financial need without being drawn into procedures or paperwork. Ideal for markets that wish to promote financial inclusion by offering hassle-free borrowing and convenient mode of saving to the unbanked and underserved.

value proposition Why Micro Savings & Lending from Modefin

mSaving - enables a bank, SACCO or mobile wallet operator to offer a micro savings account to existing customers

mLoan - an app-based solution for mobile money customers

Best-in-class tools for digital loan origination

AI-powered automated credit scoring.

In-built Fees and Commission structure for banks and wallet operators

Embedded features for automated recovery and repayment of loan

To learn more about Micro Saving & Lending download our brochure

Insights

Success Stories

Universal Merchant Bank Ghana

Universal Merchant Bank (UMB) is a leading indigenous bank in Ghana which offers a diverse range of financial services to meet the banking needs of its customers.

Equity Bank Kenya

Equity Bank Fuels massive Transformation; migrates 3.5 mn SIM application Tool kit users and brings flexibility, stability and cost savings.

Featured Blog Posts

AI in Banking: Use cases of Artificial Intelligence and Machine Learning in Banking

Artificial intelligence (AI) and machine learning (ML) have driven the inception and

Benefits of Upgradation from Monolithic to Microservices platform in Banking

Microservices architecture has grown in popularity in recent years, notably in industries

Micro Lending – The Future of Borrowing

Welcome to the future of lending! The financial landscape is undergoing a