Omnichannel Banking Solution from Modefin

Multiple products. Multiple touch points. One Platform.

SUMMARY

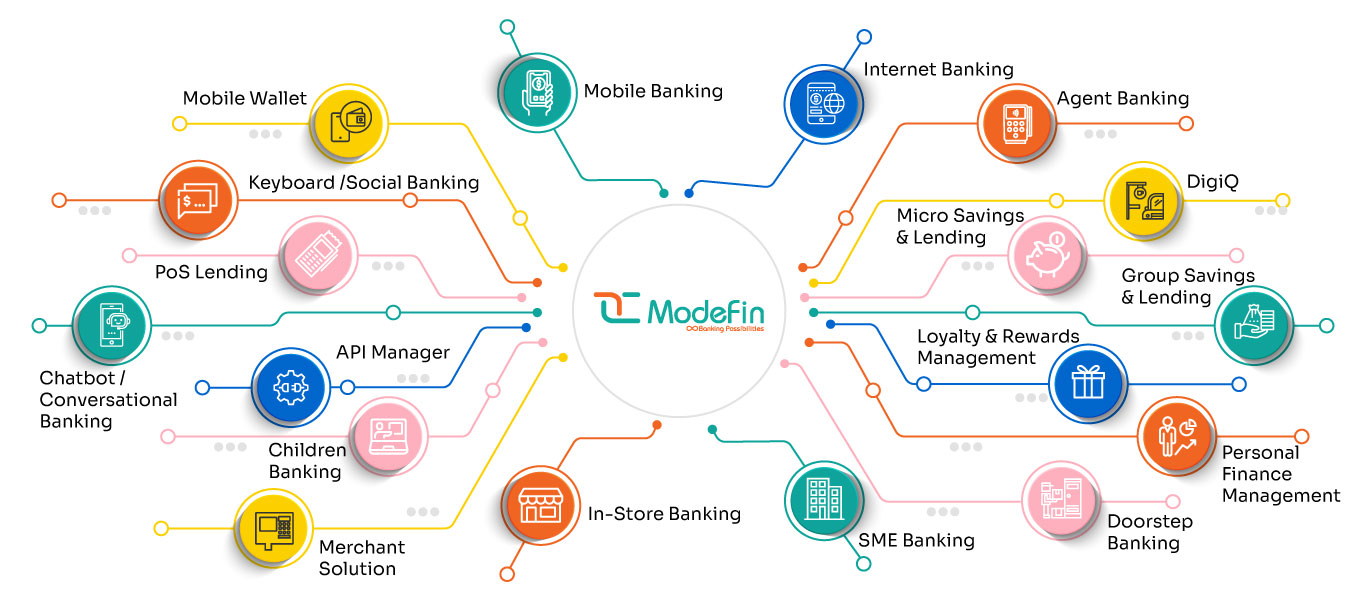

Omnichannel Banking Solution from Modefin is a proprietary platform that offers a range of Digital Banking customer services. The solution creates an Omni Presence Ecosystem that aligns with the banks’ vision and optimizes customer journey mapping by an all-inclusive approach to architecture and design of solutions.

Omnichannel banking solution integrate customer interactions across all the delivery channels like digital account opening, Web, Mobile App / Wallet, ATM, and many more indeed fasten the solution implementation.

value proposition Why Omnichannel banking from Modefin

Multiple modules - Digital Account Opening, Mobile Banking, Internet Banking, Agency Banking and Merchant Payment Banking.

Lego Block design to create new products or augment existing range.

Multi-Institution, Multi-Currency, Multi-Country, Multi-Language, Multi- Operator, Multi-Gateway & Multi-Session Support.

Independent of Hosting Infrastructure and Telecom Operator.

Controlled Access for different hierarchy levels within a Bank.

Maker-checker safeguard for all functionalities.

OEBP modules An end-to-end ecosystem for customer engagement

To reduce dependence on traditional touchpoints, and live up to its name, Omnichannel Banking must include every viable digital banking delivery channel. Trust our modules to help you engage with your end customer on web, mobile, m-Wallet and even at the point of sale.

USER CASE STUDY The True Omni channel suite of digital services

Modefin has implemented Mobile Banking and Internet Banking products using the Digital Banking suite. Republic Bank chose Modefin after an extensive selection process. Using Modefin’s Omnichannel banking technology platform, Republic Bank offers Republic Mobile, Republic Online, and Republic USSD to both new and existing customers, which will enable them to do financial transactions at their preferred.

With this collaboration, Republic Bank has deployed digital technologies to reduce operational costs and reallocate cost savings to engage its customers productively. The vision of Republic Bank is to become a leading financial institution by winning customer business through high-quality services and innovative products. Republic Bank is focused on building a full-service digital platform that meets its vision of being a digital leader and engaging its customers with best-in-class products and services.

To learn more about Omni Channel Banking download our brochure

Transform Your Banking Journey with Modefin’s Omnichannel Banking Platform. Empower your customers with our innovative banking platform, which offers smooth and fast digital banking services like Digital Onboarding, mobile banking, internet banking, etc.

Insights

Success Stories

Universal Merchant Bank Ghana

Universal Merchant Bank (UMB) is a leading indigenous bank in Ghana which offers a diverse range of financial services to meet the banking needs of its customers.

Equity Bank Kenya

Equity Bank Fuels massive Transformation; migrates 3.5 mn SIM application Tool kit users and brings flexibility, stability and cost savings.

Featured Blog Posts

AI in Banking: Use cases of Artificial Intelligence and Machine Learning in Banking

Artificial intelligence (AI) and machine learning (ML) have driven the inception and

Benefits of Upgradation from Monolithic to Microservices platform in Banking

Microservices architecture has grown in popularity in recent years, notably in industries

Micro Lending – The Future of Borrowing

Welcome to the future of lending! The financial landscape is undergoing a