Modefin Product Suite for the new-age

Digital Banking

Modefin Product Suite comes with the latest technologies and products to deliver best-in-class services to banks and financial institutions to power up the digital transformation and compete effectively in a digital-first world.

Modefin’ s experience as a product and platform enables banks to provide customers with a complete Omnichannel experience and the power to reconnect with their retail or corporate customers by providing them with a digitally transformative customer experience at every step.

The Modefin Product Suite for Digital Banking

Omnichannel Banking

Omnichannel Banking enables banks with tooling, components & frameworks for faster development of digital features.

Digital Onboarding

Modefin Onboarding Solution provides banks with a seamless journey to onboard all customers quickly and securely.

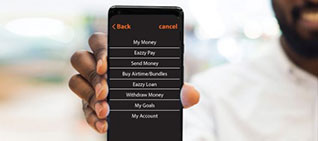

Mobile Banking

Modefin offers an intuitive, highly secure and reliable mobile banking solution tailored to meet the business needs of banks.

Internet Banking

Offer seamless and personalized experiences to your customers by leveraging advanced internet banking modules from Modefin.

Agent Banking

Reach out to millions of new customers with our low cost, secure and scalable Agent Banking Solution.

Mobile Wallet

Meet the needs and demands of modern-day customers with a flexible and scalable mobile wallet solution.

Mobile Financial Solutions

MFS is a new way of making contactless payments and using QR codes to facilitate faster mobile payments.

ChatBOT

With the chatbot, banks can offer services beyond regular business hours, boosting sales and increasing efficiency.

Digital Lending

A scalable & flexible solution to automate bank/mobile wallet operations encompassing savings & small-value lending services.

Group Savings and Lending

Modefin’s Group Savings and Loans Solution is ideal for low-income customers who come together for micro-savings and microloans.

API Manager

API Manager will build, integrate, and expose the APIs in the cloud and hybrid architectures to drive into the ecosystem.

Digital Banking

Digital banking platform helps banks to enhance operational efficiency for a better customer experience.

SWIFT MT/MX Converter

MT/MX Converter from Modefin will enable the bidirectional conversion between SWIFT MT and SWIFT MX message formats for SWIFT systems, adhering to XML ISO 20022 standards. Microservice-based architecture and containerized deployment for high performance.

Investment Club Automation

Modefin Investment Club Application will help Investment Club Associations make contributions, monitor their savings, request & pay loans, and pool money to invest. With the unequal distribution of wealth and income in Africa, investment groups increasingly provide equal opportunities for financial freedom through collective schemes.

LogAn

Modefin's Log Analyzer and Transaction Monitoring tool is the bank's digital guardian, continuously monitoring online transactions and infrastructure. LogAn delivers real-time insights and actionable alerts, helping you identify potential bottlenecks, prevent security threats, and ensure seamless customer experiences.

Insights

Success Stories

Universal Merchant Bank Ghana

Universal Merchant Bank (UMB) is a leading indigenous bank in Ghana which offers a diverse range of financial services to meet the banking needs of its customers.

Equity Bank Kenya

Equity Bank Fuels massive Transformation; migrates 3.5 mn SIM application Tool kit users and brings flexibility, stability and cost savings.

Featured Blog Posts

AI in Banking: Use cases of Artificial Intelligence and Machine Learning in Banking

Artificial intelligence (AI) and machine learning (ML) have driven the inception and

Benefits of Upgradation from Monolithic to Microservices platform in Banking

Microservices architecture has grown in popularity in recent years, notably in industries

Micro Lending – The Future of Borrowing

Welcome to the future of lending! The financial landscape is undergoing a