Self-onboarding

Help your customer with Onboarding

SUMMARY

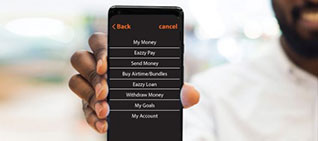

Self- led customer onboarding from Modefin is AI powered solution that empowers end customers of banks and financial institutions to independently initiate and streamline the onboarding process in a more convenient approach. It allows customers to upload their KYC documents online, eliminating the need for in-person bank visits. It empowers the customers to begin their account opening journey from the comfort of their own via a user-friendly public portal accessible from personal systems. This not only simplifies the otherwise complex onboarding process but also elevates the digital experience and customer satisfaction.

value proposition Why Self-led Onboarding from Modefin

Provides a user-friendly interface for customers, making it easy for them to submit the necessary information and complete required tasks.

Seamlessly integrate the self-services portal link to the bank’s website for convenient customer access.

Secured data transfers and encryption protocols to safeguard sensitive customer information and ensure compliance with privacy regulations.

Automate the flow of customer data, directing it to the branch for verification, validation, compliance checks, and follow-up actions as required.

Create and customize e-forms to collect a wide range of customer information while selecting the products and services.

Insights

Success Stories

Universal Merchant Bank Ghana

Universal Merchant Bank (UMB) is a leading indigenous bank in Ghana which offers a diverse range of financial services to meet the banking needs of its customers.

Equity Bank Kenya

Equity Bank Fuels massive Transformation; migrates 3.5 mn SIM application Tool kit users and brings flexibility, stability and cost savings.

Featured Blog Posts

AI in Banking: Use cases of Artificial Intelligence and Machine Learning in Banking

Artificial intelligence (AI) and machine learning (ML) have driven the inception and

Benefits of Upgradation from Monolithic to Microservices platform in Banking

Microservices architecture has grown in popularity in recent years, notably in industries

Micro Lending – The Future of Borrowing

Welcome to the future of lending! The financial landscape is undergoing a