SME Banking solution from Modefin

FEATURES

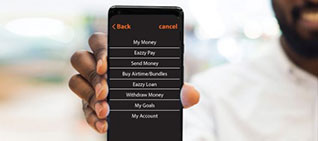

As a solution provider to emerging and developed economies, Modefin understands the value of the SME segment and their contribution to job creation and GDP growth. In Africa, SMEs account for 90% of companies, providing nearly 80% of the employment in this region. SME Banking from Modefin helps small and medium enterprises access banking services and engage in a virtual mode with the bank for credit, deposit, transaction and advisory services.

value proposition Why SME Banking from Modefin

Paperless onboarding of new customers through AI-based document verification.

mPoS - Merchants can accept digital payments through their smart phones or tablets.

Through PoS Lending, SME Merchants can offer to finance customer purchases.

QR Code-based payment solution enables payment to be credited directly to the merchant’s account.

For customers with a good credit history, opportunity to offer SME Business Loans, Supplier/Invoice financing or other value-added services

To learn more about SME Banking Solution download our brochure

Insights

Success Stories

Universal Merchant Bank Ghana

Universal Merchant Bank (UMB) is a leading indigenous bank in Ghana which offers a diverse range of financial services to meet the banking needs of its customers.

Equity Bank Kenya

Equity Bank Fuels massive Transformation; migrates 3.5 mn SIM application Tool kit users and brings flexibility, stability and cost savings.

Featured Blog Posts

AI in Banking: Use cases of Artificial Intelligence and Machine Learning in Banking

Artificial intelligence (AI) and machine learning (ML) have driven the inception and

Benefits of Upgradation from Monolithic to Microservices platform in Banking

Microservices architecture has grown in popularity in recent years, notably in industries

Micro Lending – The Future of Borrowing

Welcome to the future of lending! The financial landscape is undergoing a