Mobile Financial Solutions from Modefin

SUMMARY

With Modefin’s MFS solution, banks’ consumers can experience beyond digital payments managing their finances seamlessly from their mobile devices. Mobile Financial Solution combines Open APIs and microservices, making it a robust and versatile digital wallet that will meet the unique needs and requirements of the customers.

value proposition Why Mobile Financial Solutions from Modefin

Provided with secure, scalable, and robust technologies like passwords, biometrics, point-to-point encryptions, and out-of-band authentication, add value service to bank delivery platforms.

Manage finances seamlessly from anywhere and at any time. Users can transfer funds, pay bills, and purchase using mobile devices without visiting a bank or ATM.

Flexible to store funds in multiple currencies in purpose-driven and currency-specific wallets within a single account, eliminating the need to create local bank accounts globally.

To fend off competition aggregating multiple services, MFS has emerged as a solution for banks to win more customers.

Customized digital wallets to meet the unique needs and requirements of banks or financial institutions and can be integrated with various payment channels and payment processors for secure and seamless transactions.

Open APIs and micro services provide a powerful and versatile digital wallet infrastructure that offers a more scalable, flexible, and efficient way to manage and process payments and transactions.

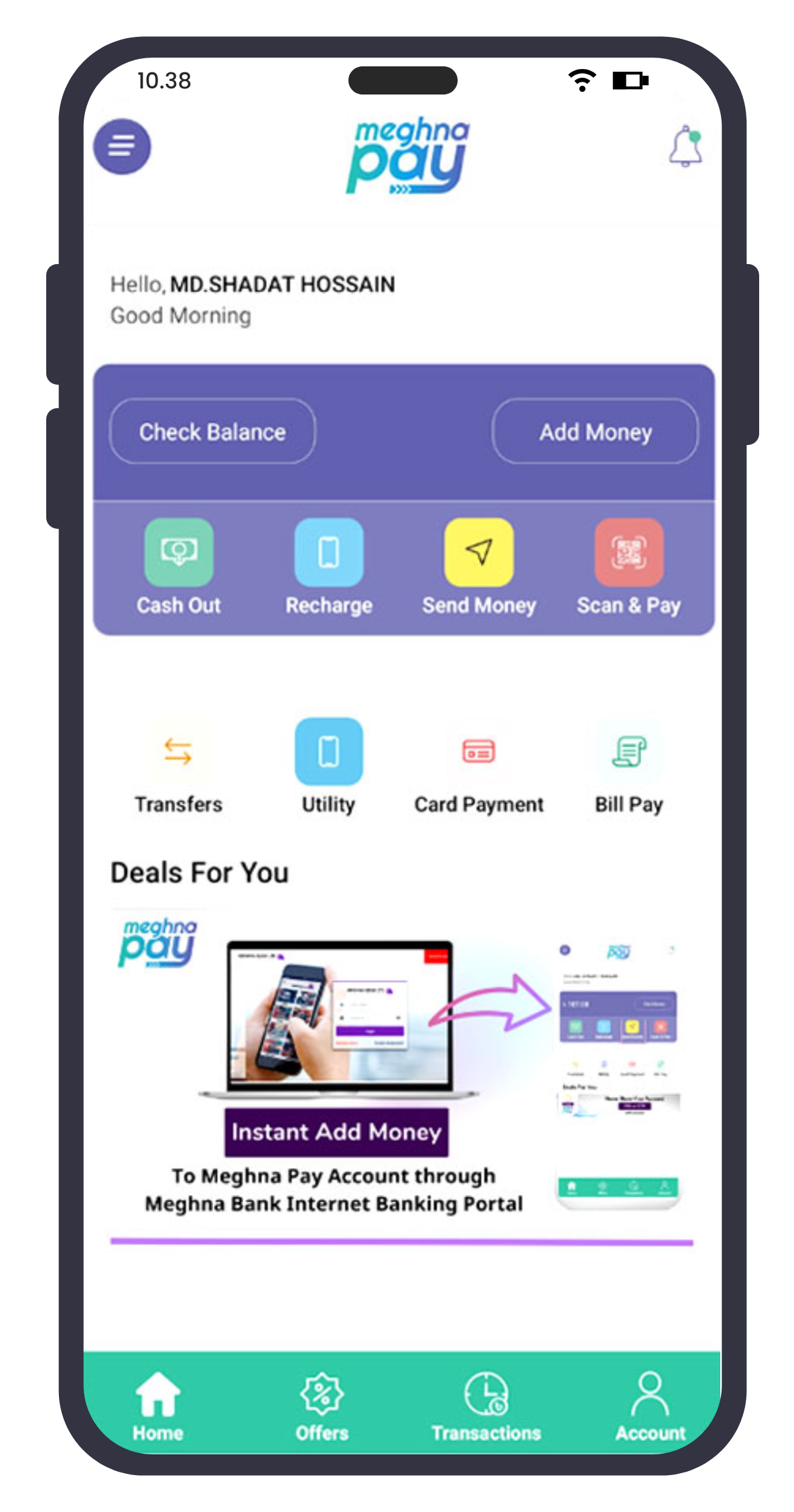

Streamline payment through mobile in easy and secure manner

Add Money

Send Money

Scan and Pay

Cash In

Cash Out

Bill Pay

Ticketing

USER CASE STUDY MeghnaPay – Mobile Financial Solution

To learn more about Mobile Financial Solution download our brochure

Insights

Success Stories

Atlas Mara Zambia

Atlas Mara Zambia, founded in 2013 in Zambia, acquired BancABC and Finance Bank of Zambia as part of its consolidation strategy.

Bank of Bhutan

Bank of Bhutan offers an advanced suite of digital banking applications, loaded with safety, convenience, and comfort, to its customer base of over 350,000.

Featured Blog Posts

AI in Banking: Use cases of Artificial Intelligence and Machine Learning in Banking

Artificial intelligence (AI) and machine learning (ML) have driven the inception and

Benefits of Upgradation from Monolithic to Microservices platform in Banking

Microservices architecture has grown in popularity in recent years, notably in industries

Micro Lending – The Future of Borrowing

Welcome to the future of lending! The financial landscape is undergoing a