Split Bills

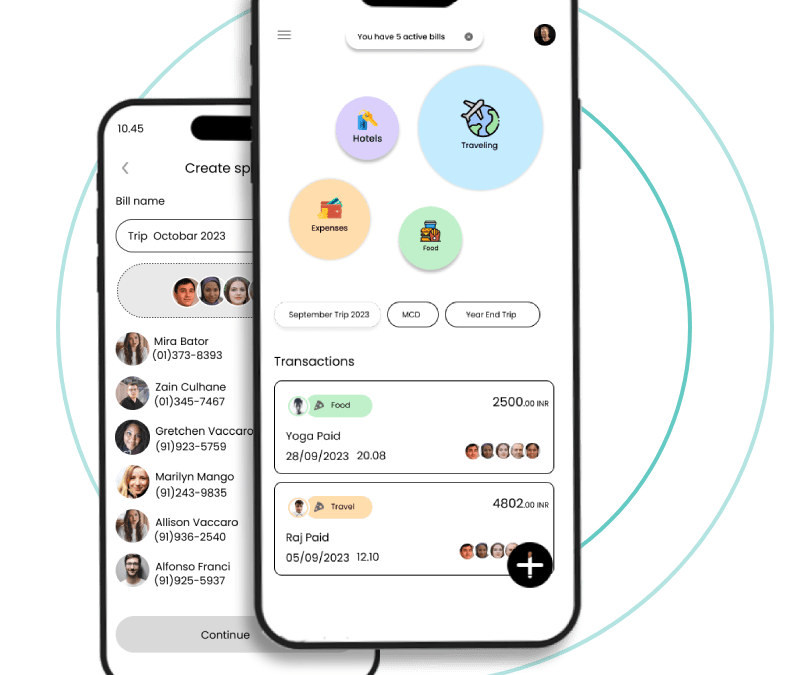

Split Bills Stop stressing about "who owes who." and easily share expenses with others.

- Go with the 'split bill' option.

- Enter the value and purpose of payment.

- Add contacts with whom you want to share the bill and proceed to continue.

Split Bills Features

Split Expenses

Users can easily split expenses with others and divide the costs equally. The app will automatically calculate each person's share.

Pay Directly

Users can pay their share directly once the expenses are divided, eliminating the need for cash transactions and simplifying the process.

User Experience

It allows users to customize their experience by selecting their preferred payment method, adding or removing friends, and editing expenses.

Trackable

The list of purchases from the shared account is displayed, making it easier for users to track expenses.

Faster

No manual calculations need making the process fast to split the bill among a large group of people.

To learn more about Spilt Bill Solution download the brochure

Spilt Bill Module is an add-on feature from Modefin helps the bank customers to track bills and other shared expenses, so that everyone gets paid back.

Insights

Success Stories

Bank of Bhutan

Bank of Bhutan offers an advanced suite of digital banking applications, loaded with safety, convenience, and comfort, to its customer base of over 350,000.

Atlas Mara Zambia

Atlas Mara Zambia, founded in 2013 in Zambia, acquired BancABC and Finance Bank of Zambia as part of its consolidation strategy.

Featured Blog Posts

AI in Banking: Use cases of Artificial Intelligence and Machine Learning in Banking

Artificial intelligence (AI) and machine learning (ML) have driven the inception and

Benefits of Upgradation from Monolithic to Microservices platform in Banking

Microservices architecture has grown in popularity in recent years, notably in industries

Micro Lending – The Future of Borrowing

Welcome to the future of lending! The financial landscape is undergoing a